The World Economic Forum has released the Global Competitiveness Report for the year 2019 and it seems the world economy is still locked in a cycle of low or flat productivity growth despite the injection of more than $10 trillion by central banks. The slow growth in the world economy is due to the congested international governance system and trade tension as we have witnessed between the two main economic players, United States and China.

On the 9th of October, Moneyweb posted an article reporting on South Africa’s recent rise in competiveness rankings. South Africa’s recent gain in momentum is largely due to changes in the political sphere and consistent strength in the financial hub, developed markets and its size as well as transport infrastructure. Although South Africa has made some improvements in the global economy, the nation’s domestic growth is still of concern. It is worrisome that we still rank poorly in terms of healthcare systems, security and labour market flexibility.

South Africa is characterized by a variety of private freedom, combined with centralized economic planning and government regulation. Although South Africa is a growing economy, it is one of the largest economies in South Africa with China, Germany and the United States as its top 3 trading partners. One of South Africa’s strengths is it regional/ continental economic power as well as the comfortable legal environment it provides its investors.

South Africa is also very rich in natural resources, mainly exporting precious stones & metals, ores, and oil & mineral fuels. Yet the economic growth of South Africa still remains lacklustre, one may ask if South Africa’s government is efficiently using the country’s resources.

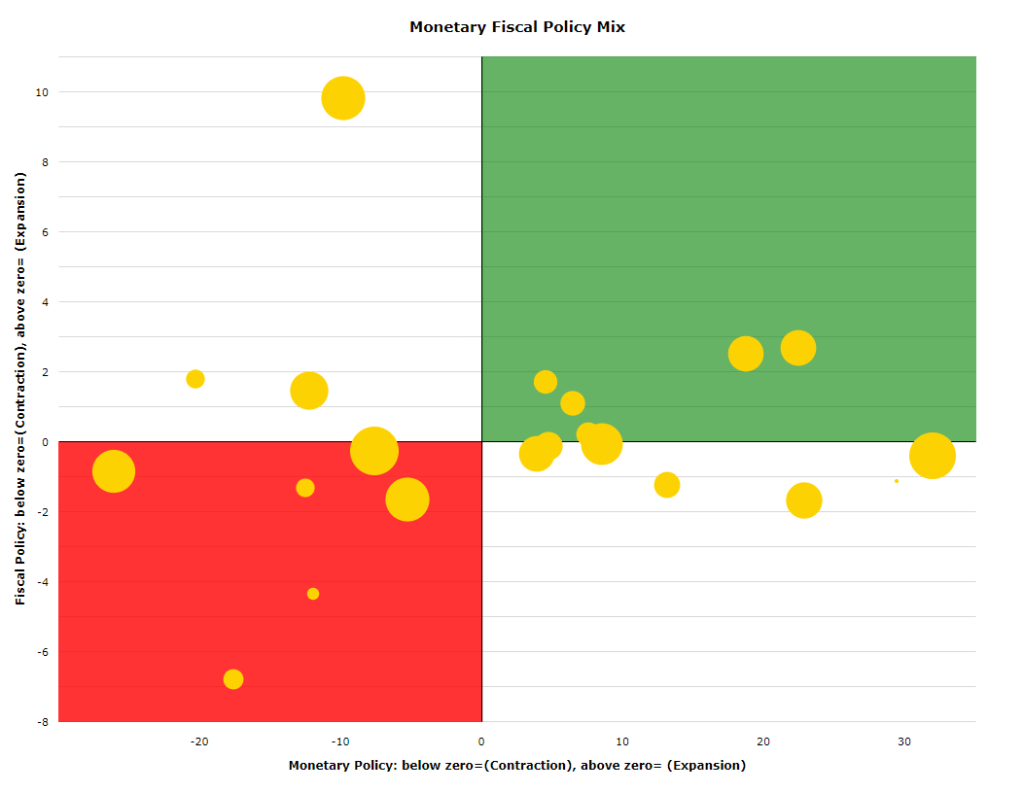

Figure 1: Monetary Fiscal Policy in South Africa associated with GDP from 1994 to 2015

Fiscal policy is used to stimulate economic and social development by the National Treasury, through the implementation of a policy stance that ensures a sense of balance between taxation, expenditure and borrowing that is consistent with sustainable growth. Over the years, we have seen a rise in government debt and the country’s deficit levels. Government expenditure has also increased significantly. The South Africa Reserve Bank (SARB) is responsible controlling the countries money supply.

In order to stimulate the economy, it is essential to have complementary monetary and fiscal policy goals. The graph depicted above shows that South Africa’s monetary and fiscal policy are not always coordinated. Contradicting policy goals have detrimental effects on the economy’s growth. The SARB’S main focus it inflation targeting while the National Treasury focuses on economic growth. Monetary and fiscal policies are ineffective if they are working towards different directions. Maybe the first problem that we’re facing as the economy is that our supplier of money is only concerned with keeping prices constant over time. The South African Market Insights suggested that The National Treasury and the Reserve Bank discuss the overall aim for South Africa in the next few years and coordinated policies in order to take advantage of favourable economic situations.

There is no “one size fits all” approach to economic growth, it is important to have policymakers that are willing to tailor policies to fit the needs of the economy. The policymakers in the euro area, United Kingdome and Japan aggressively cut central bank interest rates and implemented a variety of untested and unconventional monetary policies when the global financial crises occurred. In so doing, they increased the liquidity of banks and other financial intermediaries and later increasing the central bank’s balance sheet. The unconventional policies restored the functioning of financial markets and prevented further financial distress.

According to GlobalEdge, South Africa has a country risk rating of B and a business rating climate of A4. Country risk ratings measures the degree to which political and economic unrest affect the securities of issuers doing business in a particular country. Although the country risk rating is acceptable, the political and economic uncertainties and occasionally difficult business environment have influenced South Africa’s rating. The business environment is acceptable but corporate financial information is sometimes neither readily available nor sufficiently reliable. Debt collection is also inefficient and the institutional framework has shortcomings.

According to the World Bank, “South Africa’s current economic rebound could be short-lived if the fundamental factors undermining its growth potential are not addressed”. South Africa’s main issues are poverty and inequality, high unemployment rate, transport and energy infrastructure shortcomings, a highly volatile currency and rising inflationary pressures. South Africa has shifted from racial inequality to income inequality. Inequality leads to hunger poverty, poor healthcare and an overall increase in dependence on the state.

How can the policymakers improve South Africa’s economic growth?

Macroeconomic stability

The government needs to maintain macroeconomic stability. The National Treasury and the South Africa Reserve Bank should work towards a shared goal to ensure that macroeconomic objectives are met. Contractionary macroeconomic policies will not pursue inclusive growth and job creation with. The government has to increase aggregate demand and support supply capacity if it is to achieve economic development.

Decrease government debt and curb government spending

The government has to mobilise resources better. They can invest in municipal bonds and pension funds.

State owned enterprises

State-owned enterprises should be kept efficient.

Corruption

Good governance is essential. Policymakers need to make sure there is complete judicial independence, free from political interference.

Grow value chain

The government should focus on growing the sectors that are boosting South Africa’s growth in order to grow and diversify exports

Human capital

The government has to create an economy that is conducive for the growth and development of human capital. Human capital is at the core of development; a capable workforce will lead to a capable economy. Government has to invest in skills development programmes. The government also needs to work on improving labour market flexibility by reducing trade union power, encouraging part-time work, and encouraging new business start-ups.

In conclusion, South Africa is a well-resourced country and it seems the problems lies within the allocation and efficient use of these resources. Our lackluster growth is indeed a cause for concern. Our global ranking is of no good to us if it does not mean better stands of living for the population at large. The government needs to work hard towards dismantling inequality and alleviating poverty.